A Message From our CEO

by Madelyn McConnell

March 15, 2023

In light of recent news regarding Silicon Valley Bank and Signature Bank in New York, I wanted to assure you that Grand Savings Bank has you, our customer, as our first priority. While I understand you may have concerns, I want you to know that the Grand Savings Bank management team is focused on the continual operation of a well-capitalized institution with a strong balance sheet and quality assets. We have been consistent with our conservative investment strategy to allow for liquidity and sensitivity to market risk. We will continue to serve our customers and their needs.

You have probably seen a lot about customer deposits that are protected by FDIC Insurance. The FDIC insures up to $250,000 in eight separate account categories per depositor, per bank. In the 88-year history of the FDIC, no one has ever lost a penny of an insured deposit. We have additional resources available to guarantee that your deposits are fully ensured.

Finally, I want to remind you that we have an experienced team that is ready to always assist you with any of your questions or concerns. You can visit your local branch, reach out to your banker, or contact us through our Customer Care Center at 1-800-460-2070. We are all here to help.

Thank you for being a Grand Savings Bank customer. We appreciate you trusting us to be your community bank.

Sincerely,

Guy Cable

CEO

Understand Your Deposit Insurance

What is it?

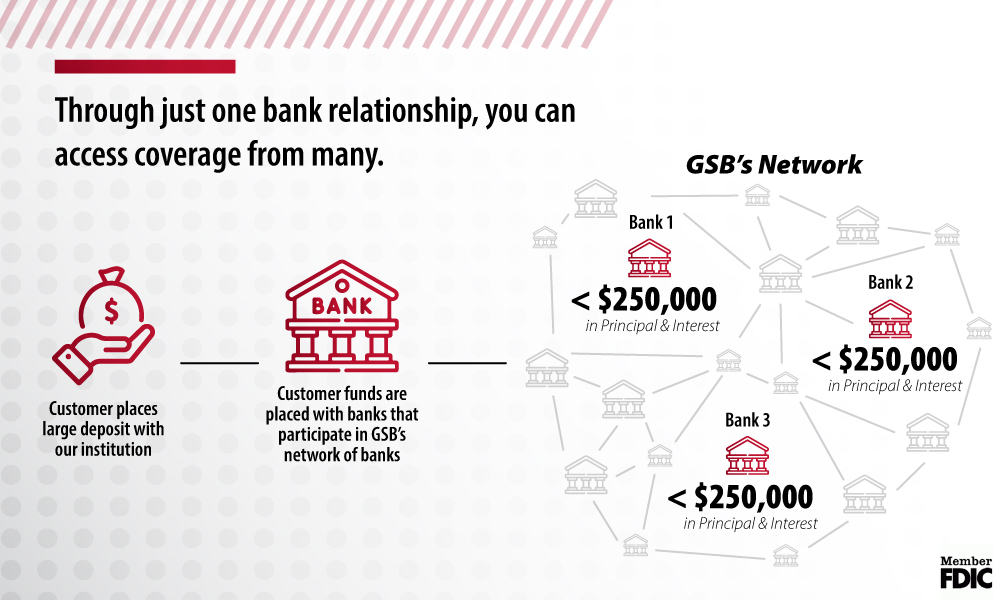

Grand Savings Bank is a member of the IntraFi network and has the ability to cover your large deposits through ICS and/or CDARS.

With ICS, your funds are placed into demand deposit accounts, money market deposit accounts, or both.

How does this work?

When we place your funds through the ICS or CDARS service, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The funds are then placed in demand deposit accounts or money market deposit accounts (using ICS), or in CDs (using CDARS) at multiple banks. As a result, you can access coverage from many institutions while working directly with just one. You receive one regular statement from our bank for each service in which you participate, and as always, your confidential information is protected.

SOURCE: 2023 IntraFi Network LLC | MEMBER FDIC